Credit card fraud takes many forms, often beginning with deceptively appealing fraudulent offers. Be wary of fake offers and unsolicited pre-approved offers, especially those requesting upfront fees.

Phishing attempts, via email scams or vishing (voice phishing), aim to steal your data. Scam alerts are crucial; legitimate institutions won’t ask for sensitive information like your card verification value (CVV) or PIN security codes.

Deceptive practices include mimicking legitimate companies. Always verify the sender’s authenticity before clicking links or providing details. Understanding these tactics is the first step in fraud prevention and financial protection.

Recognizing Common Fraudulent Tactics

Fraudulent offers frequently exploit consumer desires for low rates or rewards. Be extremely cautious of unsolicited pre-approved offers, particularly those arriving via email or social media. These are often designed to initiate phishing schemes, aiming to capture your personal and financial data. Legitimate offers will rarely require immediate action or upfront fees.

Email scams are a pervasive threat. Look for red flags such as poor grammar, spelling errors, and generic greetings. Never click on links within suspicious emails; instead, navigate directly to the company’s official website. Similarly, be wary of vishing – phone calls claiming to be from your bank or credit card issuer requesting sensitive information. Reputable institutions will never ask for your full credit card number, card verification value (CVV), or PIN security code over the phone.

Scam alerts often highlight urgent situations designed to pressure you into acting quickly. Scammers may impersonate government agencies or well-known businesses. Always verify the legitimacy of any request before providing information. Be particularly skeptical of offers that seem “too good to be true” – they almost always are. Recognizing these deceptive practices is vital for protecting yourself from credit card fraud and identity theft. Remember to scrutinize all communications and prioritize online security.

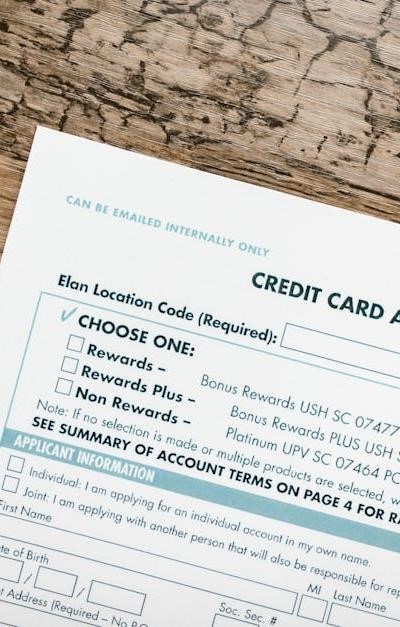

Furthermore, be aware of fake offers promising instant approval or unusually high credit limits. These are often used to collect your information for malicious purposes. Always independently verify the offer through official channels before applying. Protecting your credit score and overall financial protection requires a healthy dose of skepticism and diligent verification.

Proactive Measures for Financial Protection

To proactively defend against fraudulent offers and scam alerts, regularly review your credit report from all three major credit bureaus. This allows you to identify any unauthorized accounts or suspicious activity early on. Consider utilizing credit monitoring services for automated alerts regarding changes to your credit score and report.

Strengthen your account security by enabling two-factor authentication wherever possible. This adds an extra layer of protection beyond just a password. When shopping online security is paramount; always ensure websites use SSL certificates (look for “https” in the address bar) and are reputable. Avoid using public Wi-Fi for sensitive transactions.

Be vigilant about protecting your personal information. Shred documents containing financial details before discarding them, and be cautious about sharing information on social media. Never respond to unsolicited requests for your card verification value (CVV) or PIN security code. Implement strong, unique passwords for all your online accounts.

Regarding pre-approved offers, carefully read the terms and conditions before applying. Understand the interest rates, fees, and any associated risks. If an offer seems questionable, research the company thoroughly before providing any information. Practicing these fraud prevention measures significantly reduces your risk of becoming a victim of credit card fraud and identity theft, bolstering your overall financial protection.

Responding to Fraudulent Activity and Utilizing Consumer Protections

If you suspect you’ve encountered a fraudulent offer or are a victim of credit card fraud, immediate action is crucial. First, contact your credit card issuer to report fraud and request a new card number. Initiate chargebacks for any unauthorized charges – your liability is typically limited to $50, and often waived entirely.

Carefully review your account statements for any suspicious transactions. If you identify dispute charges with your bank or credit card company, providing detailed documentation to support your claim. Simultaneously, file a report with the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB). These agencies track fraud trends and can assist in investigations.

Consider placing a fraud alert on your credit report with one of the credit bureaus; this will notify creditors to verify your identity before opening new accounts. In cases of identity theft, you may need to file a police report and consider a security freeze on your credit reports. Be aware of your rights under the Fair Credit Billing Act, which provides consumer protection against billing errors.

Document all communication with your bank, credit card issuer, and government agencies. Understanding your rights and promptly utilizing available consumer protection mechanisms are vital steps in mitigating the damage caused by financial scams and regaining control of your financial protection. Don’t hesitate to seek assistance from these resources.

Ongoing Fraud Prevention and Resources

Proactive fraud prevention requires vigilance. Regularly monitor your credit report for any inaccuracies or suspicious activity. Utilize credit monitoring services, which can alert you to potential identity theft and changes to your credit score. Be cautious about sharing personal information online and ensure secure websites – look for “https” and a valid SSL certificate – before entering sensitive data.

Enable two-factor authentication whenever possible for an extra layer of account security. Be skeptical of unsolicited communications, even if they appear legitimate. Remember that legitimate companies will rarely request personal information via email or phone. Stay informed about current scam alerts and deceptive practices by following the Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) websites.

Protect your physical cards by being aware of skimming devices at ATMs and point-of-sale terminals. Shred financial documents before discarding them to prevent mail fraud. Educate yourself and your family about the latest financial scams and email scams. Regularly update your computer’s security software and practice strong password hygiene.

Resources like IdentityTheft.gov provide step-by-step guidance on recovering from identity theft. By consistently implementing these security tips and staying informed, you can significantly reduce your risk of becoming a victim of credit card fraud and maintain robust financial protection.

A solid, practical guide to avoiding credit card fraud. I particularly liked the breakdown of how fraudulent offers work – explaining that they exploit desires for rewards or low rates is insightful. The warning about upfront fees is crucial; that

This is a really concise and helpful overview of common credit card fraud tactics. I appreciate that it specifically calls out both phishing *and* vishing, as many people focus solely on email scams. The emphasis on verifying sender authenticity and being skeptical of «too good to be true» offers is excellent advice. It